A thought piece written by Natan Reddy (Principal) and Sherry Wang (MBA Associate)

Throughout the last year, 25madison’s supply chain team has undertaken various research sprints as we diligence potential incubation and investment opportunities. While developing these sprints internally, we saw an opportunity to share some of our research with our community.

Our latest research sprint focused on the intersection of middleware and supply chain, and we are excited to share some excerpts of what we have learned.

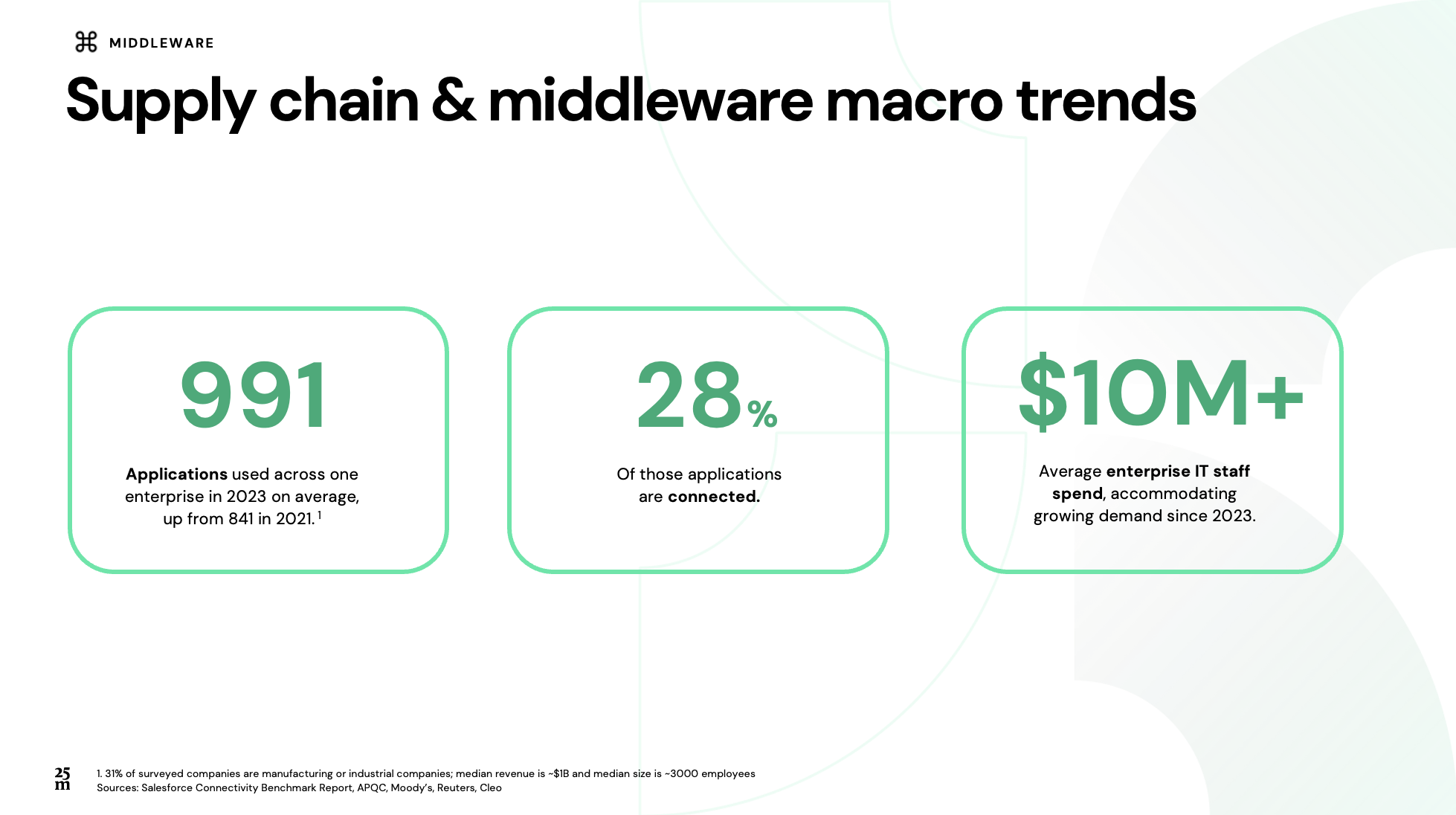

In 2023, the average enterprise used nearly 1,000 applications and spent almost $10.5M on IT staff, according to a recent survey from Salesforce. When surveyed, integrated business planning was cited as the top priority for companies assessing their supply chains, with 49% of companies citing it versus 25% citing last year, according to a benchmarking survey by APQC. These statistics suggest that enterprise leaders are seeing the value in facilitating connectivity across supply chains, especially as data becomes increasingly crucial to supply chain strategy.

In addition, the need for middleware is further driven by the explosion of available modular point solution apps, the increasing confidence and willingness of companies to adopt third-party solutions, and further enhanced by the resulting fatigue we have heard from CIOs of working with so many disparate solutions.

For these reasons, it is clear that there is a timely need for solutions that enhance supply chain integration and connectivity.

So how do we define “middleware”?

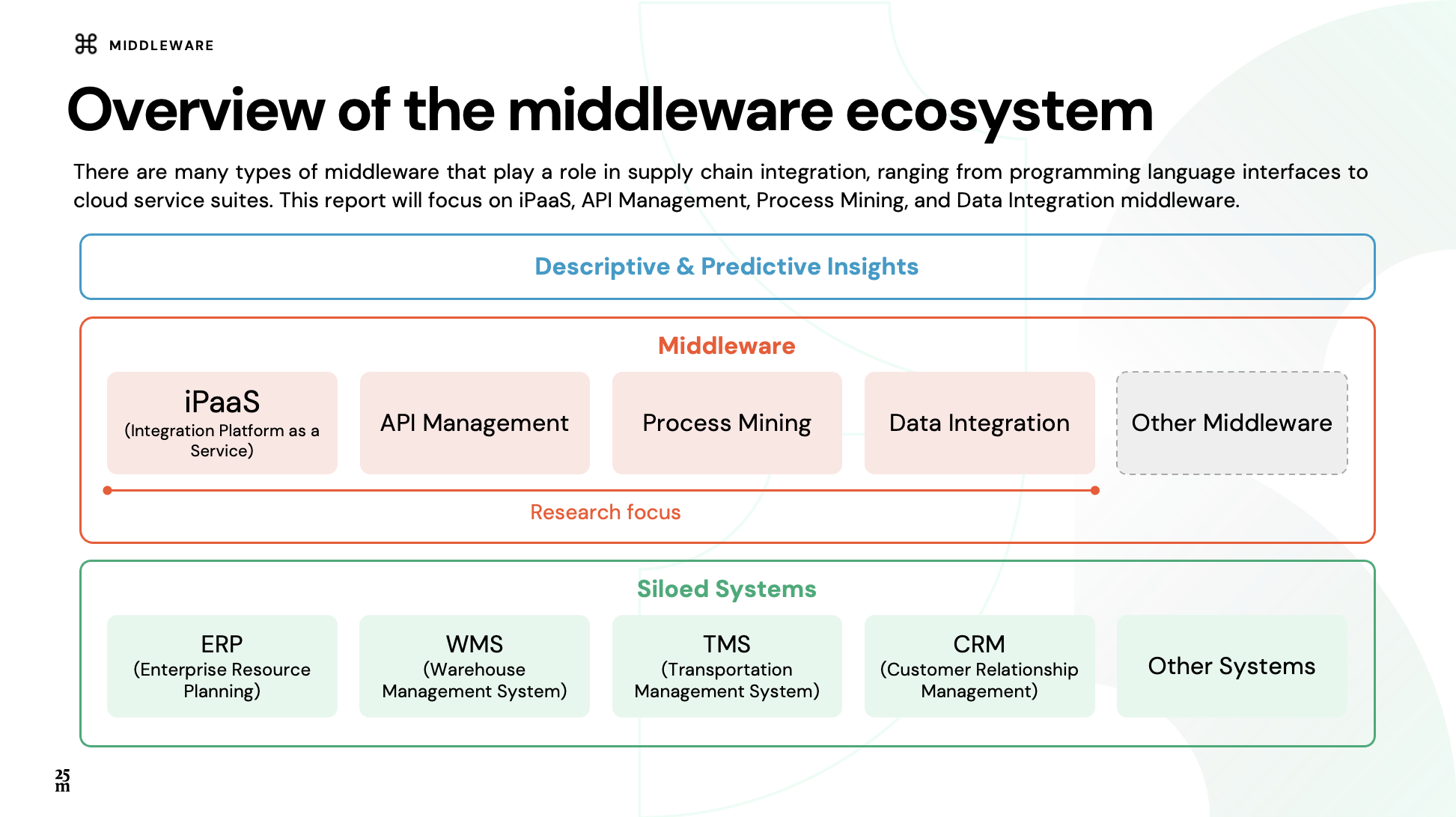

At a high level, middleware can be defined as software that bridges gaps between applications, databases, and operating systems, providing unified services to users. Middleware brings together disparate data sources and systems to facilitate communication, data exchange, and connectivity by acting as “software glue”.

What types of companies do we look at in our research?

We focus on trends, startups, and technologies in the middleware market, with an emphasis on Integration Platform as a Service (iPaaS), API Integration & Management, Process Mining, and Data Integration solutions that can serve supply chain customers (defined for our purposes as the manufacturing and logistics verticals). For these organizations, this includes solutions that integrate ERPs, CRMs, TMSs (Transportation Management Systems), WMSs (Warehouse Management Systems), and other systems and facilitate data exchange. We also focus primarily on non-open-source solutions and exclude generalist workflow automation tools.

Examining the intersection of supply chain + middleware

The middleware market is experiencing several tailwinds that make this a uniquely strong time to invest and build in the space.

Need for Supply Chain Resiliency: Although down from the peak of the pandemic, 2023 supply chain-related disruptions still led to an average $82 million in annual losses per organization, according to a supply chain survey by Interos. 98% of companies believe ecosystem integration will help their company uphold supply chain business commitments, according to an integration market report by Cleo. Supply chain software integration has emerged as an urgent and critical priority for business leaders, driving the need for innovative middleware solutions.

Increasing Supply Chain IT Spend: 96% of supply chain IT leaders plan to invest $100K+ in supply chain technologies in 2024, with 51% pledging $1M+. Increasing IT spending reflects a growing demand for tech-enabled supply chain solutions. Organizations now manage an average of 991 applications across their digital environments, with an average lifespan of four years.

Data Connectivity & Gen AI: Generative AI opens doors for the next phase of advancement in middleware, and can enable fast, cost-effective, and seamless integration, content analysis, request-response, task performance, and system updates across a company's IT landscape. GenAI needs to be trained on accurate enterprise data and middleware can help connect applications to provide a foundation of accurate, actionable data and cohesion across diverse systems.

As we dove into the middleware space, we found it important to map the ecosystem and value chain at a high level, and to focus in on a particular component of the value chain.

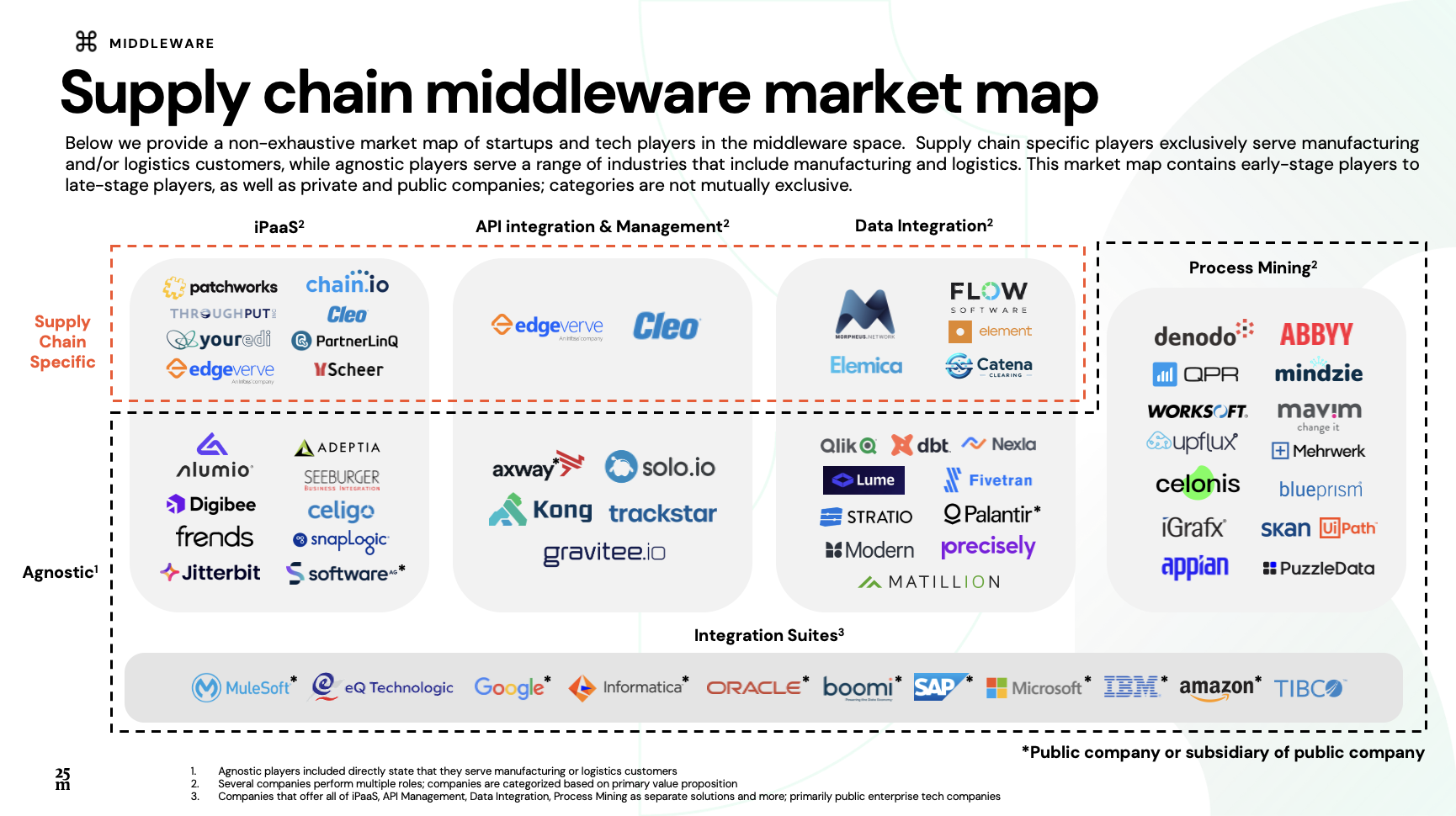

With this focus area in mind, we compiled a non-exhaustive list of startups operating at the intersection of supply chain and middleware. We chose to include solutions that exclusively serve logistics and/or manufacturing, as well as industry-agnostic solutions that include logistics and/or manufacturing under the umbrella of categories that they serve. Overall, funding to the category has been relatively in line with that of the broader supply chain and tech market, though it is worth noting supply chain-exclusive deals have generally increased since 2020.

Taking a closer look at some of the companies represented in the funding graph, we created a non-exhaustive market map of startups operating at the intersection of supply chain and middleware. While agnostic solutions (which include supply chain-focused offerings in part) make up a crowded field, there are far fewer companies focused exclusively on the supply chain arena – leaving open potential white space for those solving industry-specific pain points. We also feature incumbent solutions in the market map to illustrate the breadth of their offerings.

While many of these startups are still nascent, a future exit and consolidation landscape could include potential acquisitions from the following companies – grouped into various cohorts across logistics, supply chain management software, and broader enterprise tech vendors.

Key takeaways

After surveying the landscape, and speaking to multiple founders, investors, operators, and industry experts, we concluded that the following key takeaways:

1️⃣ Technologist Origins: Successful companies often emerge from a data or software engineering foundation, often as open-source or internal projects in response to a common pain point a founder faced. They are often the first to commercialize a new technology or pioneer a new use case with existing technology.

2️⃣ Niche Entry Point: Many middleware companies got their start as a solution to a niche problem (e.g. Boomi for e-commerce website integration, Oracle for relationship database technology). Once the tech is refined, companies can quickly expand to a wide range of use cases, becoming industry-agnostic. Many initial solutions capitalize on the timing of new technology (web, SaaS, cloud), and often leverage emerging standards and methods.

3️⃣ Network Advantage: Building a network upfront is critical. The more integrations a company has built, the more efficient it becomes at adding new integrations, and the customer acquisition cost decreases. This is because not only are connectors reusable, but network growth also incentivizes software partners to build connectors to become a part of the integration ecosystem.

4️⃣ Industry Expertise: The unique integration needs of logistics providers make industry expertise and relationships crucial for any integration solution. Their systems interact with the systems of thousands of customers and suppliers and require specialized solutions. Meanwhile, broader internal supply chain systems are often housed in SAP or Oracle and face less need for supply chain-specific middleware.

5️⃣ The Middleware Market is Crowded: Market research reveals that several mature enterprise tech companies offer nearly identical supply chain integration middleware products, nevertheless, there remains opportunity across the broader integration value chain – ranging from requirements gathering to end-to-end testing, among others.

6️⃣ Supply Chain-Specific Solutions are Scarce: There are few solutions across any category that exclusively serve supply chain. Manufacturing-specific solutions are mostly catered to industrial data aggregation & analytics, often with a heavy focus on IOT integration.

Our team continues to research and surface potential opportunities across this category. If you are interested in connecting as a founder, co-investor, industry expert, or design partner, please feel free to reach out to a member of our team via LinkedIn, X/Twitter, or email.

Please note the information published is not intended to be investment advice.

A special thank you to Sherry Wang, our MBA Associate on 25madison's supply chain team, for her major contribution to this piece, and to all founders, investors, and experts who played a critical role in our research.