Buying insurance is no longer the painful process it used to be. The rise of insurance technology, known as insurtech, has made insurance fit the needs of the modern consumer, personalized, and more user-friendly than ever.

What is Insurtech?

Let’s start with the basics, what is insurtech and how did it come to be? Insurtech refers to the use of technology innovations designed to create new revenue streams and squeeze out savings and efficiency from the current insurance industry model. A quick history lesson: the term “insurtech” did not exist until late 2015, see the Google search results trend graph for “insurtech” below.

Insurtech came to be as increasing digitally literate customers began to demand greater efficiency and better customer experiences from their insurance companies. Though the insurance industry has been slow to innovate, emerging insurtech companies have forced a new wave of innovation in the space.

Insurtech is a massive market

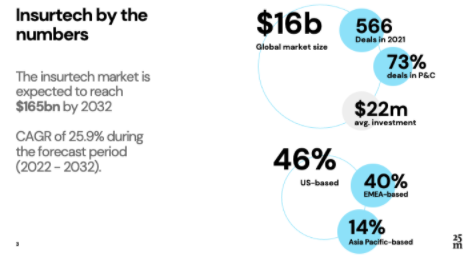

The insurtech market is valued at $16.6 billion in 2022 and is expected to grow at an impressive rate reaching $165.4 billion by 2032.i As an investor, this represents an attractive time to enter space, as the market is expected to boom in the next 10 years.

There is already plenty of VC activity in the space validating that the insurtech industry is at an exciting pivotal point. For example, in 2021 insurtech firms raised $15.4 billion in funding across 566 deals, double the total funding in 2020. Most deals were in Property Casualty including categories such as renter’s insurance, pet insurance, auto insurance, and more -- this accounted for 73% of insurtech deals. ii

Insurtechs succeed by embracing the latest technology trends

Established insurance companies find it hard to adopt new technologies due to legacy systems and processes. Emerging insurtechs, however, leverage technology to their advantage. They can provide insurance far more efficiently, and cheaply with the use of innovations such as:

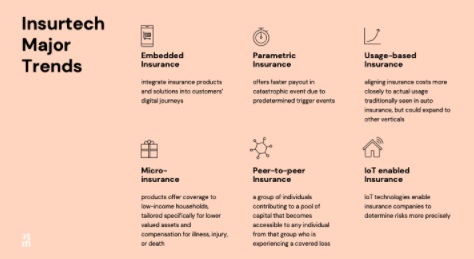

- Embedded Insurance – move the process of purchasing insurance into customer’s existing e-commerce flows e.g. buying electronics insurance at the same time as purchasing a laptop.

- Parametric Insurance – offers faster payouts after catastrophic events due to predetermined trigger events.

- Usage Based Insurance - aligning insurance costs more closely to the actual usage of the product being insured. Traditionally has been seen in auto insurance but could expand to other verticals.

- Microinsurance - insurance for less valuable assets which also offers payouts for injury, sickness, or death. These products are tailored to lower income, developing regions.

- Peer-to-Peer Insurance - a group of individuals contributing to a pool of capital that becomes accessible to any individual from that group who is experiencing a covered loss

- Internet of Things (IoT) - using IoT devices to assess risk and prevent damage to the underlying asset (e.g. homes, or cars)

How do Insurtechs make money?

We’ve seen that successful insurtech startups fall into three main buckets:

- Product Innovation Insurtechs: These insurtechs are introducing a novel new insurance product previously unseen that customers are willing to pay for. Alternatively, they are serving a previously underserved market with a new insurance product tailored to this market’s specific needs, e.g. customers in developing countries, or millennials.

- Distribution Innovation Insurtechs: These insurtechs use new technology to compare policies and provide insurance faster, and they can more cheaply process claims by using AI/ML. Often they have mobile-first, user-friendly interfaces. Some insurtechs in this bucket have invented new distribution models such as Lemonade which uses an emerging peer-to-peer insurance model.

- Cost Reduction Insurtechs: These startups use blockchain and other emerging technology to process claims faster, and more accurately. They reduce human labor costs and therefore net a bigger margin on products. Oftentimes they are B2B propositions partnering directly with larger established insurance companies.

How we think about Insurtech

As we have studied the insurtech landscape over the last few months, a few white spaces emerge with high potential for disruption, and big payoffs.

- Customers are increasingly willing to exchange personal data for discounts on insurance – Startups such as Metromile and Hippo are using IoT devices to track customers’ usage of their cars and home and use the data to price insurance products. While a few years ago this may have been viewed as a huge invasion of privacy, now internet-connected devices such as Google Home / Alexa are commonplace. Any startups utilizing usage data or even publicly available information online e.g. public social media profiles, or similar information should be able to create insurance that is more personalized and aligned to individual customer behavior.

- Greater demand to process claims and provide quotes faster, and desire for mobile-first experiences – The pandemic resulted in an acceleration in digital uptake. For example, e-commerce sales in the US grew as much in the first half of 2020 as in the previous ten years. People now expect to be able to buy everything from cars and clothes to insurance online. Startups that embrace this digital boom and make it more convenient and faster to buy insurance online will be able to take advantage of this trend.

- Expansion in APAC: 46 percent of existing insurtech companies are headquartered in the US with another 40 percent based in EMEA. While the Asia-Pacific region accounts for only 14 percent of the insurtechs today, it is expected to be the fastest growing region in the coming years.iii Investors and founders alike should look to Asia-Pacific as a source for new investments, as well as where innovation will stem from. The insurance needs of consumers in APAC are far different than in the US and we can expect to see microinsurance and peer-to-peer insurance models take off in that region.

We are excited to see how this industry develops in the coming years, and what innovative new startups emerge. If you are working on anything in this space, we are always looking to chat with founders. Please DM us, or submit an application to build with us!

...

i. https://www.futuremarketinsights.com/reports/insurtech-market

ii. https://www.ey.com/en_us/insurance/insurtech-trends-and-investment-landscape?AA.tsrc=paidsearch&WT.mc_id=10650879&s_kwcid=AL%2110073%2110%21768285